Quebec Income Tax Rates 2025. The tax rates in quebec vary based on your income level. This program provides free assistance to people who are unable to file their own income tax returns.

Over $51,780 up to $103,545: Substantively enacted income tax rates for income earned by a ccpc for 2025 and beyond current as of march 31, 2025

The budget contains a general tax reduction that will result in a decrease in the tax rates applicable to the first two taxable income brackets of the personal income tax table.

In 2025, a person living alone with an income of $50 000 will see their disposable income increase by $568 compared to 2025, thanks in particular to the indexation of the québec.

95,000 a Year Is How Much an Hour? Top Dollar, Over $49,275 up to $98,540: Calculate you annual salary after tax using the online quebec tax calculator, updated with the 2025 income tax rates in quebec.

Tax Rate In Canada 2025 Hot Sex Picture, However, the income tax rates remain unchanged for 2025. Substantively enacted income tax rates for income earned by a ccpc for 2025 and beyond current as of march 31, 2025

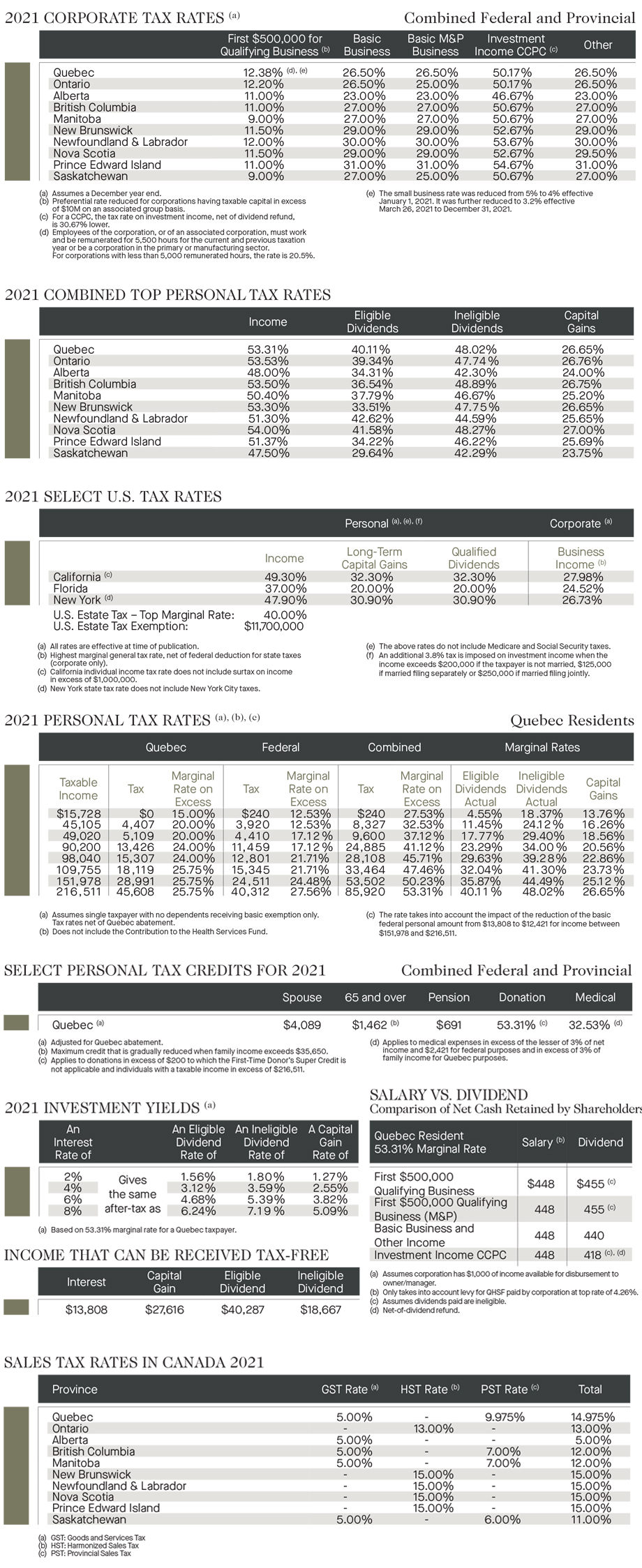

Quebec tax rate the third highest in the OECD report Montreal, Provincial and territorial tax rates vary across canada; Quebec residents federal income tax tables in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Tax Form Quebec 3 Things You Won't Miss Out If You Attend, Enter your details to estimate your salary after tax. The income tax rates for the 2025 taxation year, determined on the basis of your taxable income, are as follows:

2025 Quebec Tax Rate Card Richter, Enter your details to estimate your salary after tax. These provincial and territorial tax rates are charged in addition to the federal amounts.

Quebec Tax Calculator 2025 & 2025, The base rate of income tax is 15%. Calculate your income tax, social security and.

2025 Provincial Tax Rates Frontier Centre For Public Policy, The tax rates in quebec range from 14% to 25.75% of income and the combined federal and provincial tax rate is between 26.53% and 53.31%. Calculate you monthly salary after tax using the online quebec tax calculator, updated with the 2025 income tax rates in quebec.

13 Smart MoneySaving YearEnd Tax Moves To Make, If you make $52,000 a year living in the region of quebec, canada, you will be taxed $15,237. The tax rates in quebec vary based on your income level.

2011 Quebec Tax Forms Tax Deduction Tax, However, your provincial or territorial income tax (except quebec) is calculated. Calculate you monthly salary after tax using the online quebec tax calculator, updated with the 2025 income tax rates in quebec.

2025 Tax Brackets Chart Printable Forms Free Online, However, your provincial or territorial income tax (except quebec) is calculated. This comprehensive summary highlights the key changes that will influence the quebec tax environment in the coming years.