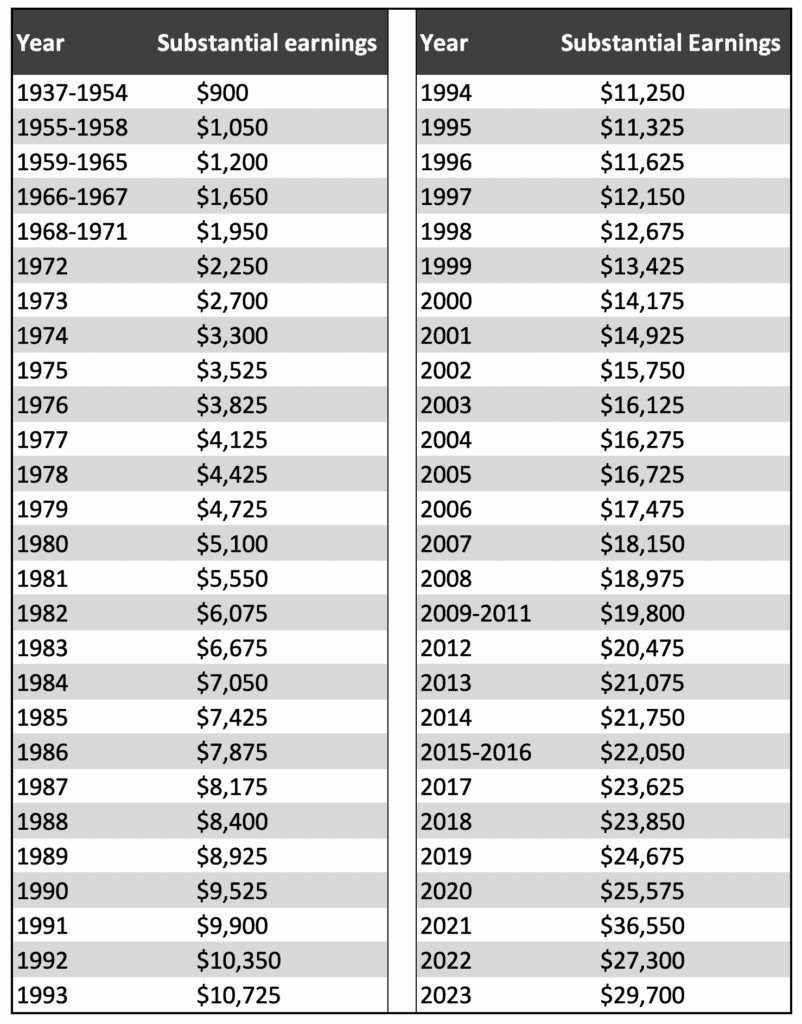

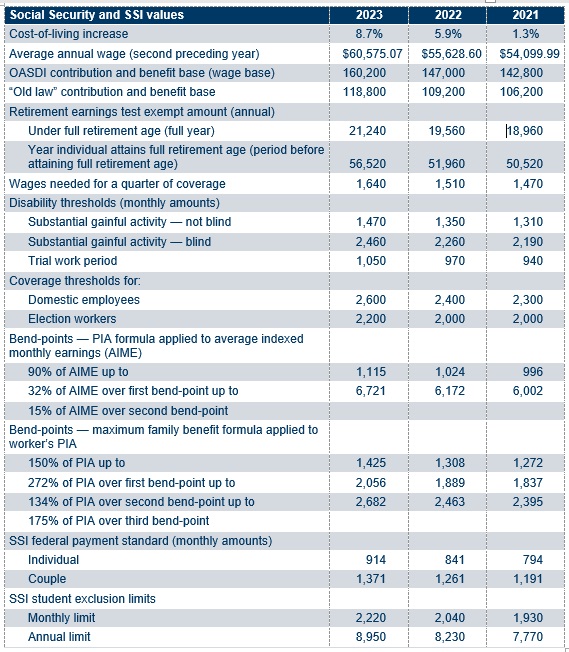

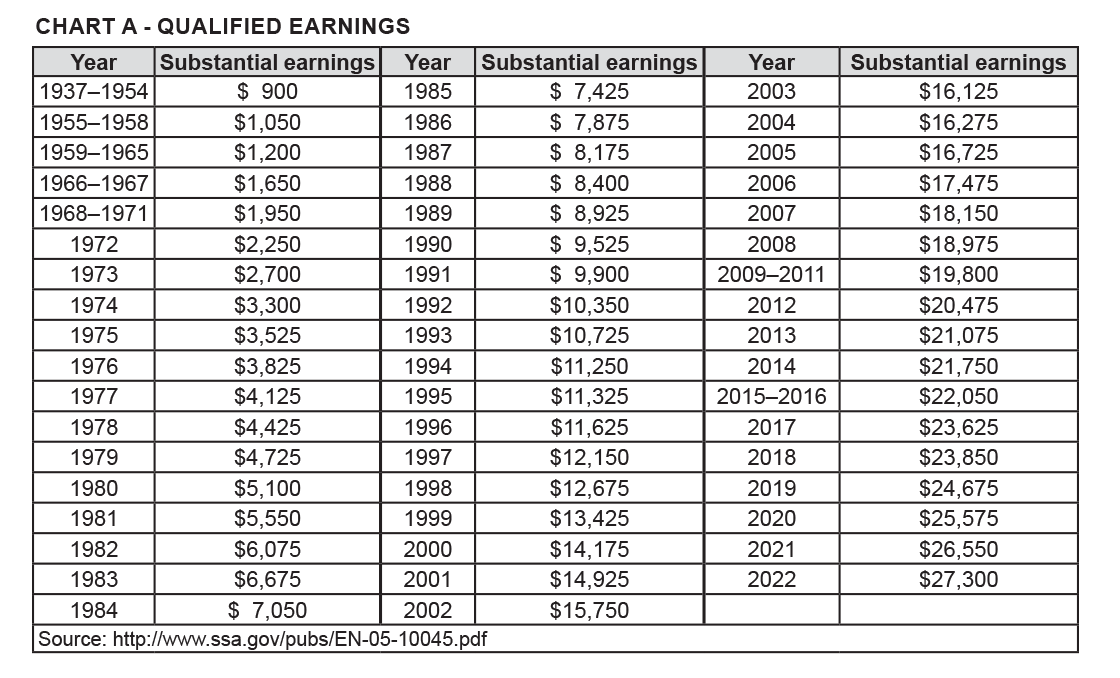

Social Security Earnings Threshold 2025. If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $59,520. The following table shows the maximum earnings.

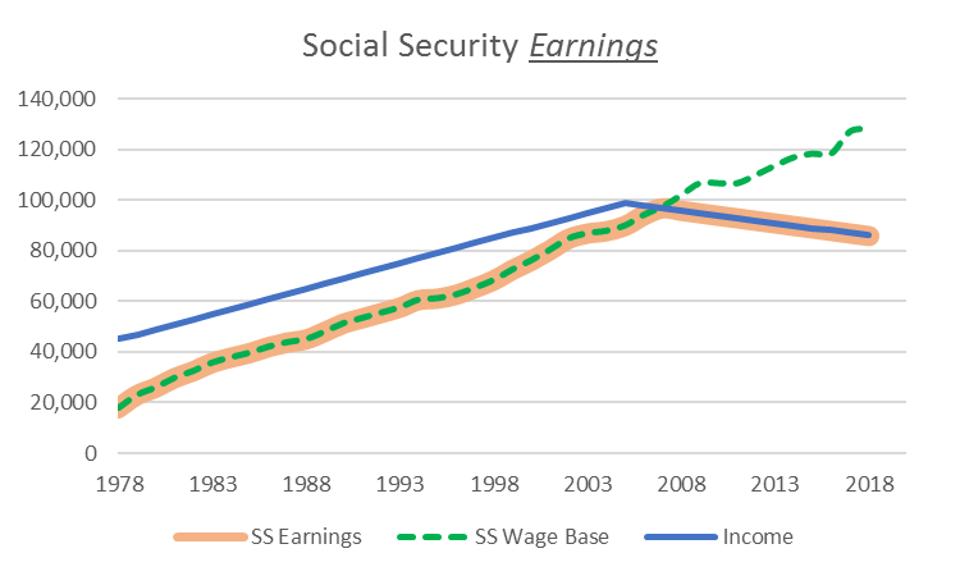

If you are working, there is a limit on the amount of your earnings that is taxed by social security. That’s what you will pay if you earn $168,600 or more.

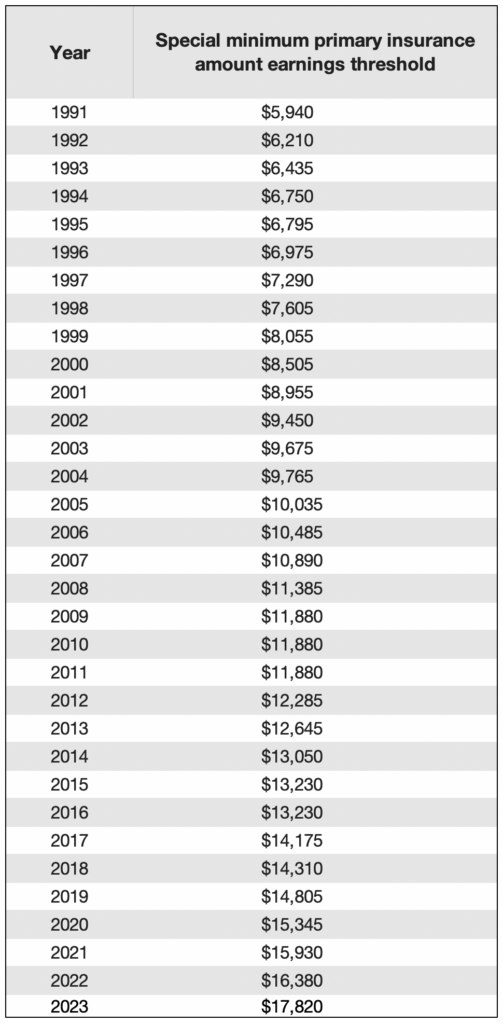

For 2025, we increased the medicaid while working state threshold amounts for persons with disabilities.

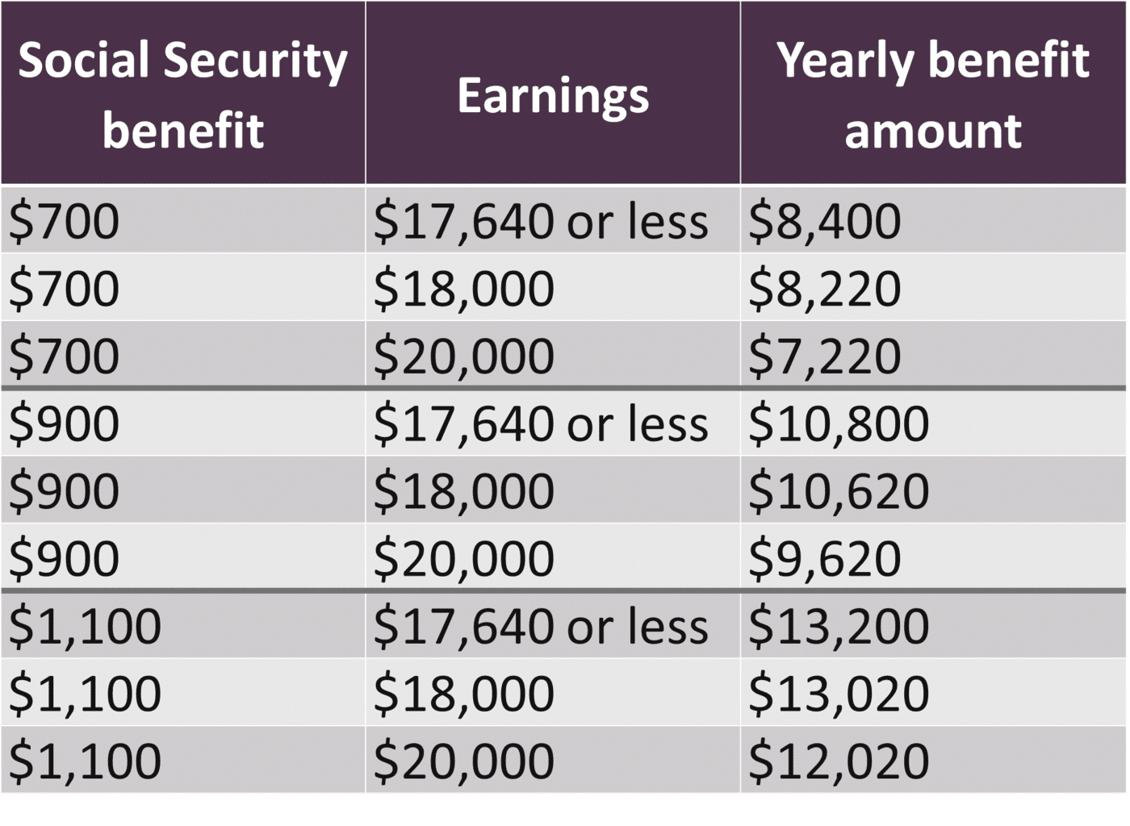

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, If you reach full retirement age in 2025, you’re considered retired in any month you earn $4,960 or less. The social security administration deducts $1 from your social security check for every $2 you earn above the cap.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png)

Limit For Maximum Social Security Tax 2025 Financial Samurai, If you are working, there is a limit on the amount of your earnings that is taxed by social security. The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each.

The Best Explanation of the Windfall Elimination Provision (2025 Update, The most you will have to pay in social security taxes for 2025 will be $10,453. In 2025, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for every.

What is the Minimum Social Security Benefit? Social Security Intelligence, Starting with the month you reach full retirement age, you. This amount is known as the “maximum taxable earnings” and changes each.

Social Security Benefits Chart, The rules of the internal revenue service dictate that many who receive social security benefits will have to pay an. For earnings in 2025, this base is $168,600.

2025 Social Security, PBGC amounts and projected covered compensation, In 2025, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for every. But retirees who receive the maximum social security payout will see much higher earnings, with their monthly checks jumping to $4,873 in 2025, according to the.

Social Security SERS, Specific coverage thresholds for 2025. Earnings above that level are not taxed for the.

How Does My Affect My Social Security Retirement Benefits?, For 2025, that limit is $22,320. Specific coverage thresholds for 2025.

Paying Social Security Taxes on Earnings After Full Retirement Age, Earnings above that level are not taxed for the. If you are working, there is a limit on the amount of your earnings that is taxed by social security.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

How Work Earnings Affect Your Social Security Benefit, The rules of the internal revenue service dictate that many who receive social security benefits will have to pay an. In 2025, you paid social security taxes on work income up to $160,200.

The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each.