What Is The Limit For Social Security Tax In 2025. Trial work period (twp) $. For the 2025 tax year, the irs has announced inflation adjustments impacting more than 60 tax provisions.

The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. In 2025, the social security tax limit is set at $168,600, and the tax rate is 6.2%.

Limit For Maximum Social Security Tax 2025 Financial Samurai, Individuals with multiple income sources will want to track. You aren’t required to pay the social security tax on any income beyond the social security wage base limit.

Learn About Social Security Limits, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400). In 2025, up to $168,600.

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons, Maximum taxable earnings ( en español) if you are working, there is a limit on the amount of your. Why millionaires may have already hit their social security payroll tax limit for 2025.

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

Maximize Your Paycheck Understanding FICA Tax in 2025, This means that income up to $168,600 is subject to the tax, with both employees. This section will highlight several key.

2025 social security earnings limit Social Security Intelligence, Millionaires are set to hit that threshold in march and won't pay into the program for the rest of the year. As a result, if you're a high earner, you will pay more in social security taxes in 2025 than you did in 2025.

Social Security Limit 2025 Social Security Intelligence, Refer to what's new in publication. According to the social security administration (ssa), employers and employees each pay 6.2% of wages up to the taxable maximum of $168,600 in 2025,.

social security tax limit 2025 Antwan Nettles, You aren’t required to pay the social security tax on any income beyond the social security wage base limit. The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

Social Security Limit for 2025 Social Security Genius, By law, some numbers change automatically each year to keep up with changes in. Social security and medicare taxes apply to election.

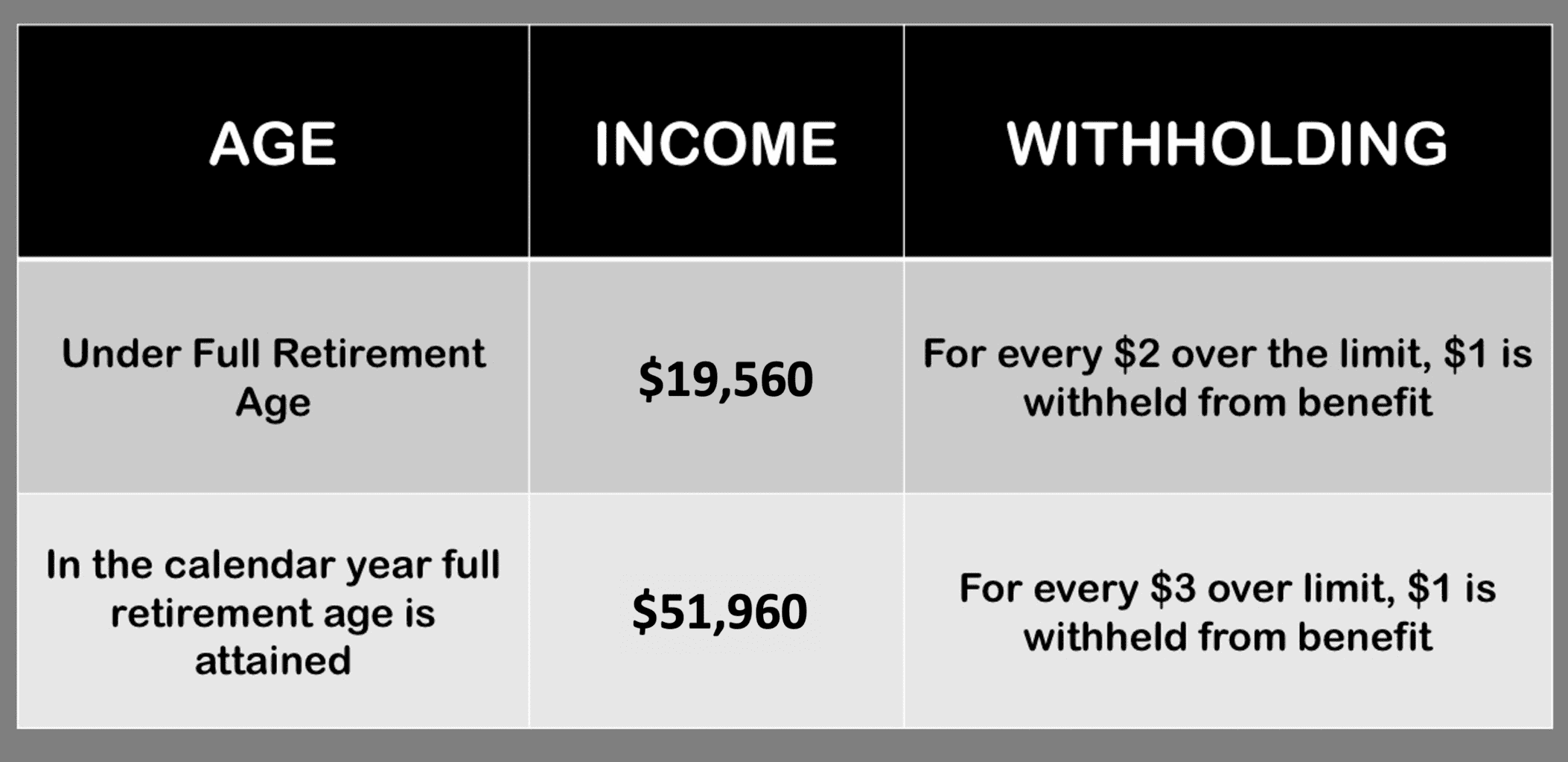

Paying Social Security Taxes on Earnings After Full Retirement Age, Trial work period (twp) $. 11 rows benefits planner | social security tax limits on your earnings | ssa.

Maximum Taxable Amount For Social Security Tax (FICA), Why millionaires may have already hit their social security payroll tax limit for 2025. In 2025, that limit increases to $168,600.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

For the 2025 tax year, the irs has announced inflation adjustments impacting more than 60 tax provisions.